COVID-19 Impact on U.S. Consumer Technology Spending

Business IntelligenceCOVID-19 Impact on U.S. Consumer Technology Spending

In normal times, consumer attitudes, needs, and behavior are dynamic, changing constantly. COVID-19 has further accelerated change and in unpredictable ways. The brands that do the best job of understanding consumers’ changing needs and behavior will outperform their competitors and build trust.

The Last 30 Days

U.S. consumers spent on technology at a torrid pace over the last 30 days, according to IDC’s inaugural Purchase and Subscription Index survey fielded between April 17th and April 27th. The survey runs on a continuous, monthly cadence.

To get an idea of exactly how much consumers spent, consider this: if annualized, the “pace” of their spending over this short period of time would be over $6,000. That’s 37% above the just under $4,400 they reported spending per household in 2019.

Widespread stay at home orders had a major impact, thrusting consumers into unexpected school and work at home situations. Sparked by a real and pressing need for PCs and tablets to accommodate these situations, 59% of consumers’ tech expenditures were on devices – compared to just 25% normally. In normally times, services and subscriptions represent 74% of consumer spend.

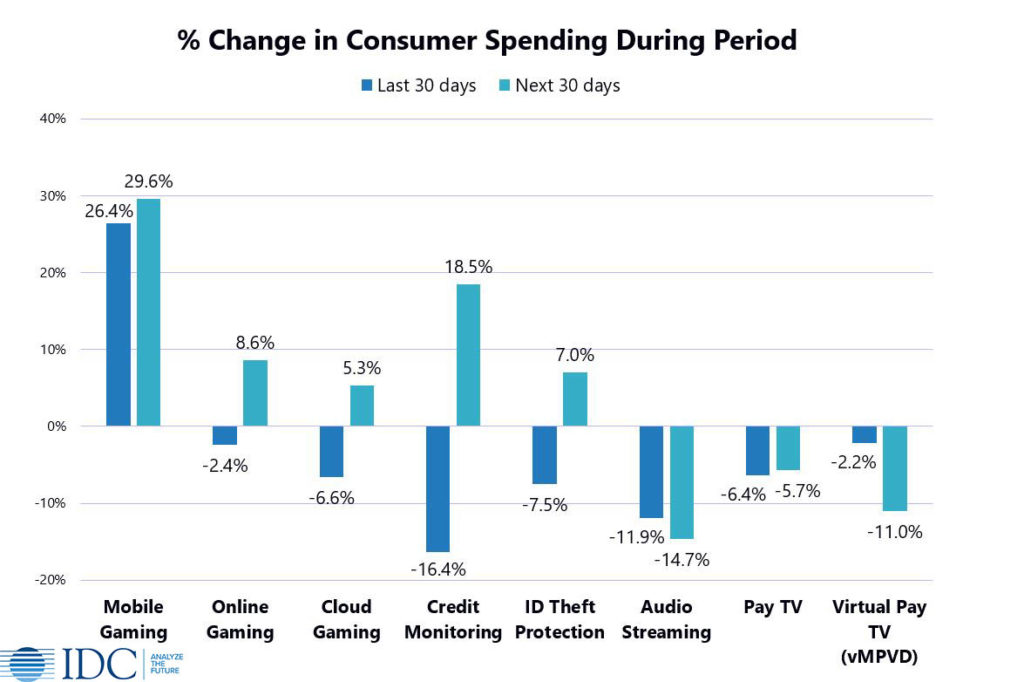

Faced with no choice but to spend on devices, consumers did their best to compensate, at least a little, by rationalizing their spend on services, cutting back 2.3% overall. Service categories where free alternatives are prominent, such as credit monitoring, identity theft protection, and audio streaming were among the biggest losers. Of the services measured, only mobile gaming (ex. Apple Arcade, Google Play Pass, etc.) saw significant growth at 26% as consumers filled their time with fun distractions.

Crises like this one impact different groups of consumers differently. Over the last 30 days, consumers in the middle of the market had a larger device-buying presence than normal. This was reflected in the price points consumers reported paying. Consumers at the top ($100K+ incomes) and bottom (under $35K) of the market had a smaller presence than usual. Those at the top were more likely to already have the needed devices; those at the bottom were more likely to feel unable to spend, given the circumstances.

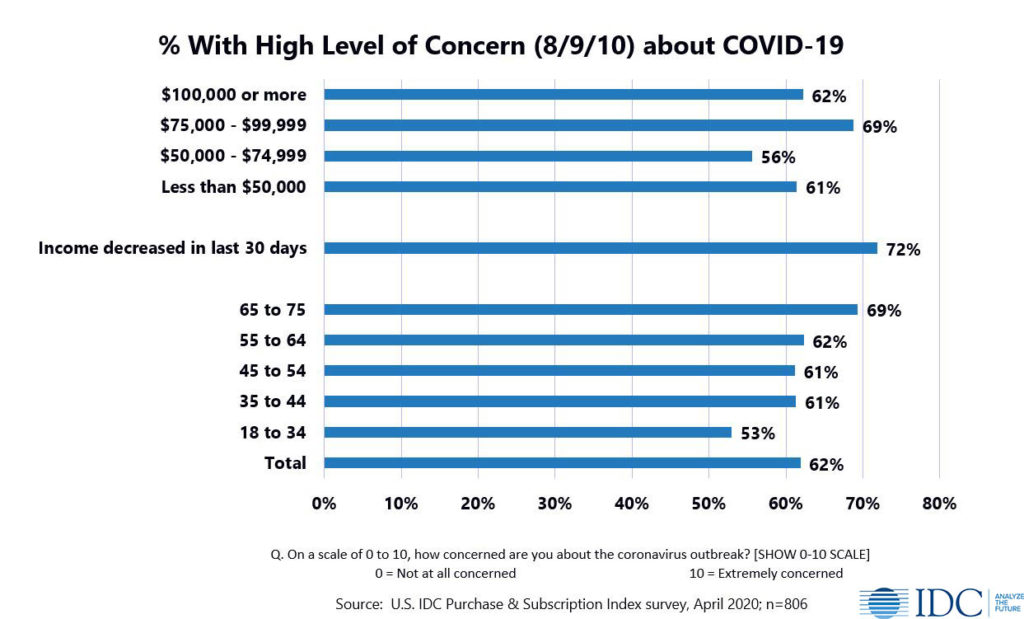

Consumer Concern

Consumers are really worried about their future. 29% of consumers reported a drop in their income over the last 30 days. About two-thirds have a high level of concern about COVID-19.

The Next 30 Days

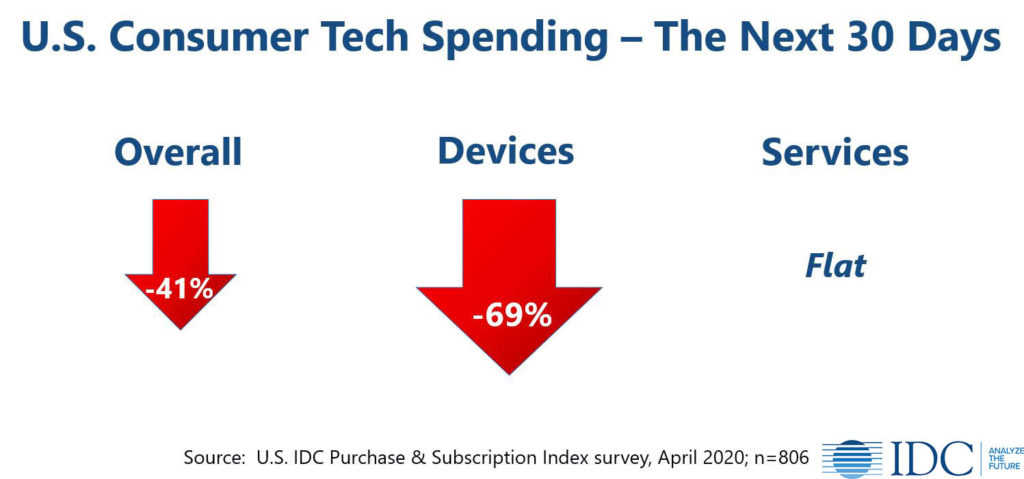

Much different than in the last 30 days, consumers expect to pull back sharply on device spending over the next 30 days, now that their immediate, unique, one-time needs have been met.

Service spending is expected to be flat, but not because consumers are standing pat. Those under 35 were some of the largest device spenders and cut back sharply on services during the last 30 days. In the next 30 days, they plan to return to their prior level of spending (an increase of 7%). In contrast, those ages 55-64, who increased spending 1% in the last 30 days are now set to pare back their budgets by 4%.

Over the next 30 days, mobile gaming looks to be the single biggest winner, with an expected growth of 30% on top of 26% growth last month. Online gaming (ex. Xbox LIVE, PlayStation Plus, Nintendo Switch, etc.) and cloud-streamed gaming (ex. PlayStation Now, Google Stadia, NVIDIA GeForce Now, etc.) are also expected to see solid growth.

Credit monitoring and identity theft protection will largely recover last month’s significant losses. However, audio streaming will see its second straight month of double-digit cuts and will ultimately face a very difficult second quarter. Consumers will also pull back for a second straight month on spending for Pay TV and Virtual Pay TV (ex. HULU Live TV, Sling TV, YouTube TV, etc.). See who’s gaining momentum and who’s losing traction in this market in IDC’s newest Market Perspective.

Key Takeaways for Consumer Marketers

- Consumer attitudes, needs, behavior, and spend are very dynamic.

- Gain competitive advantage by keeping close tabs and acting quickly.

- Recognize that service subscriptions provide consumers with flexibility that they will use. In the end this benefits both consumers and service providers.

- Consumers benefit due to the flexible, no penalty nature of most of these agreements. This allows them to swiftly shift spending and manage their budgets.

- Service providers benefit by holding on to more revenue than they would if it were the “all or nothing” kind of dynamic provoked by annual contracts or significant penalties.

- Many consumers demonstrate a strong willingness to resume service spending after navigating the current blip.

- Resist the urge to adopt policies that “lock in” consumers.

- Expect a much softer than normal year-end holiday season for devices.

IDC’s Consumer Technology Strategy Service (CTSS) leverages a system of frequent consumer surveys to provide B2C marketers with the full view of the consumer they need to anticipate and meet changing consumer needs and to outperform their competitors. This includes robust monthly data (including on interest in 5G devices and service), timely insights, quarterly webinars, and ongoing analyst access.

Nothing could be more valuable now, in the midst of the COVID-19 crisis. Find out more with IDC’s on-demand webinar, “Market Pulse: COVID-19 Impact on Consumer Technology Spend.”

Research Vice President, Consumer Strategies